The Challenge

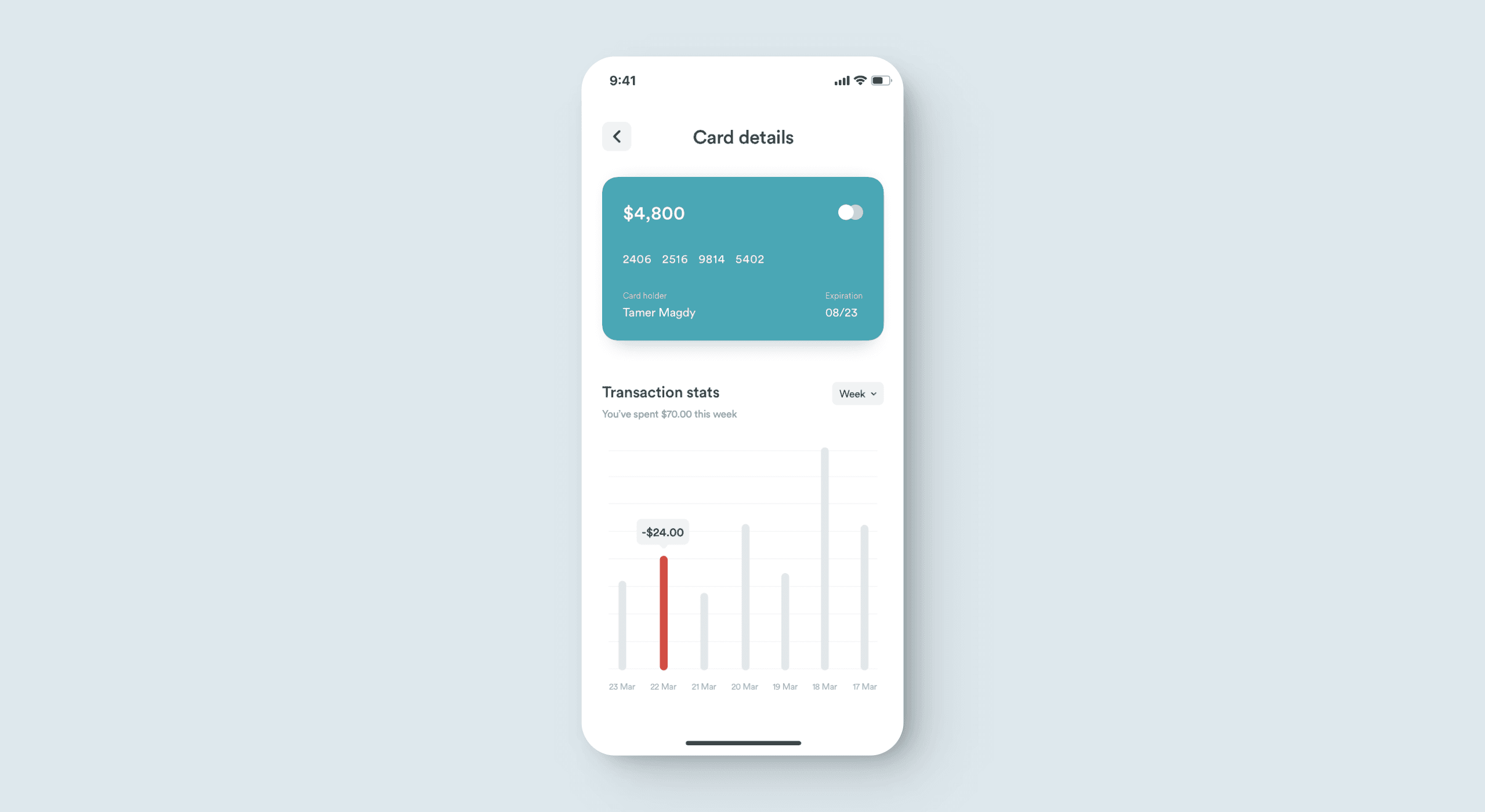

The challenge for the personal finance mobile application was to provide users with a comprehensive solution for tracking their credit cards, managing their transactions, subscriptions, bills, and controlling their expenses. With numerous financial responsibilities, users needed a centralized platform that could help them easily manage their finances, avoid unnecessary expenses, and achieve their financial goals. The challenge was to create a user-friendly, intuitive, and feature-rich mobile application that could meet these diverse financial needs and provide users with a seamless experience.

The Problem

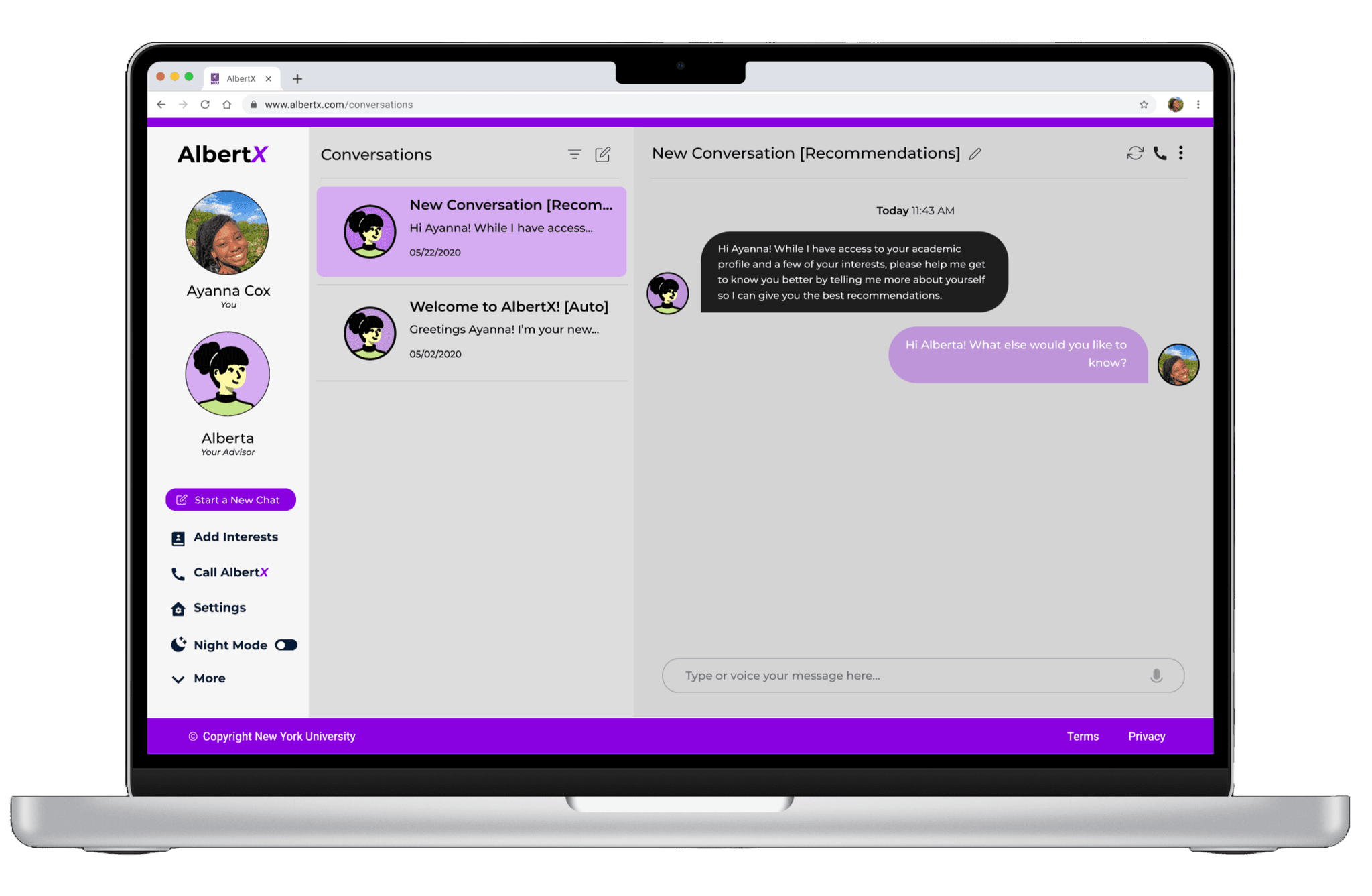

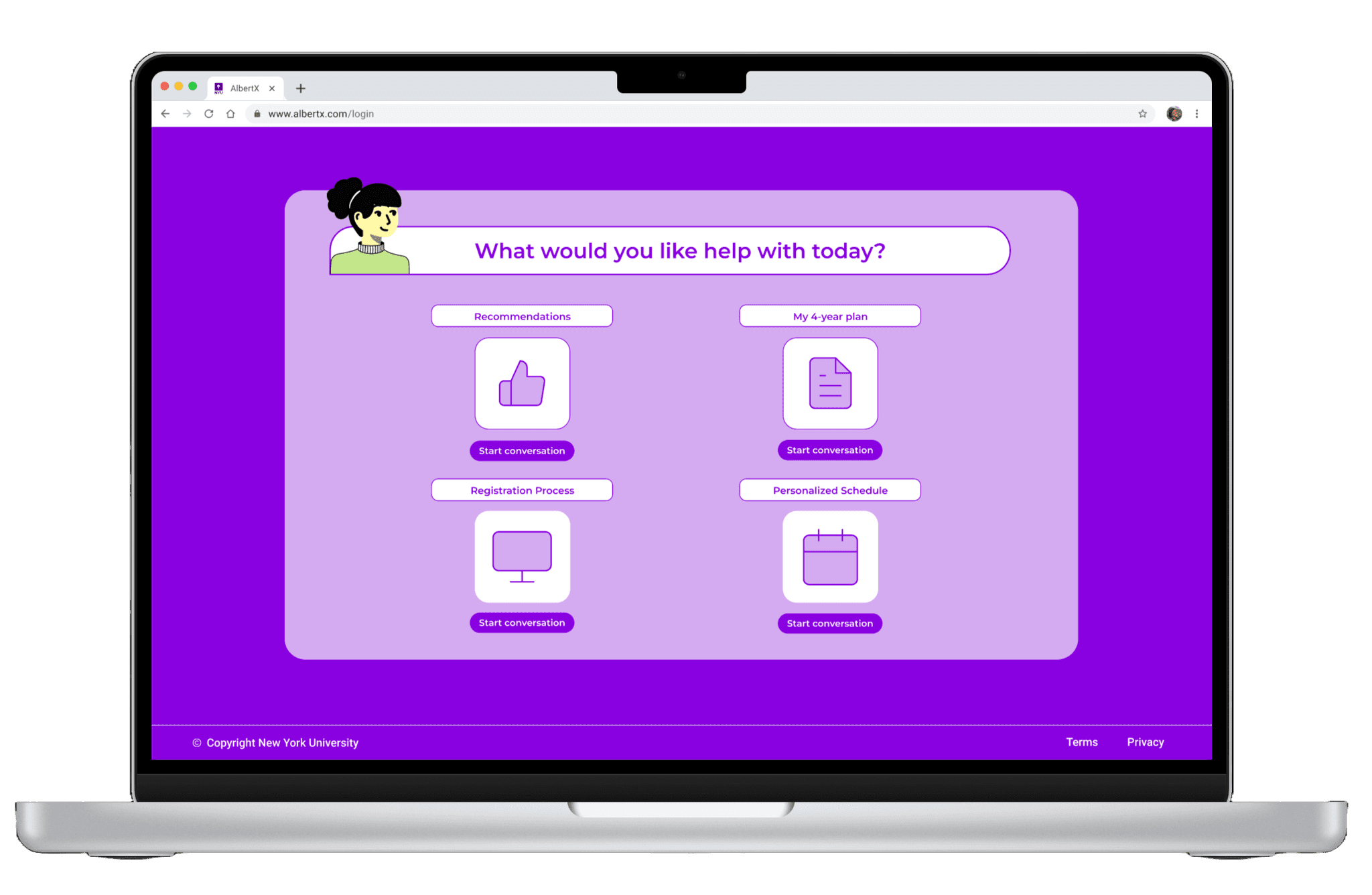

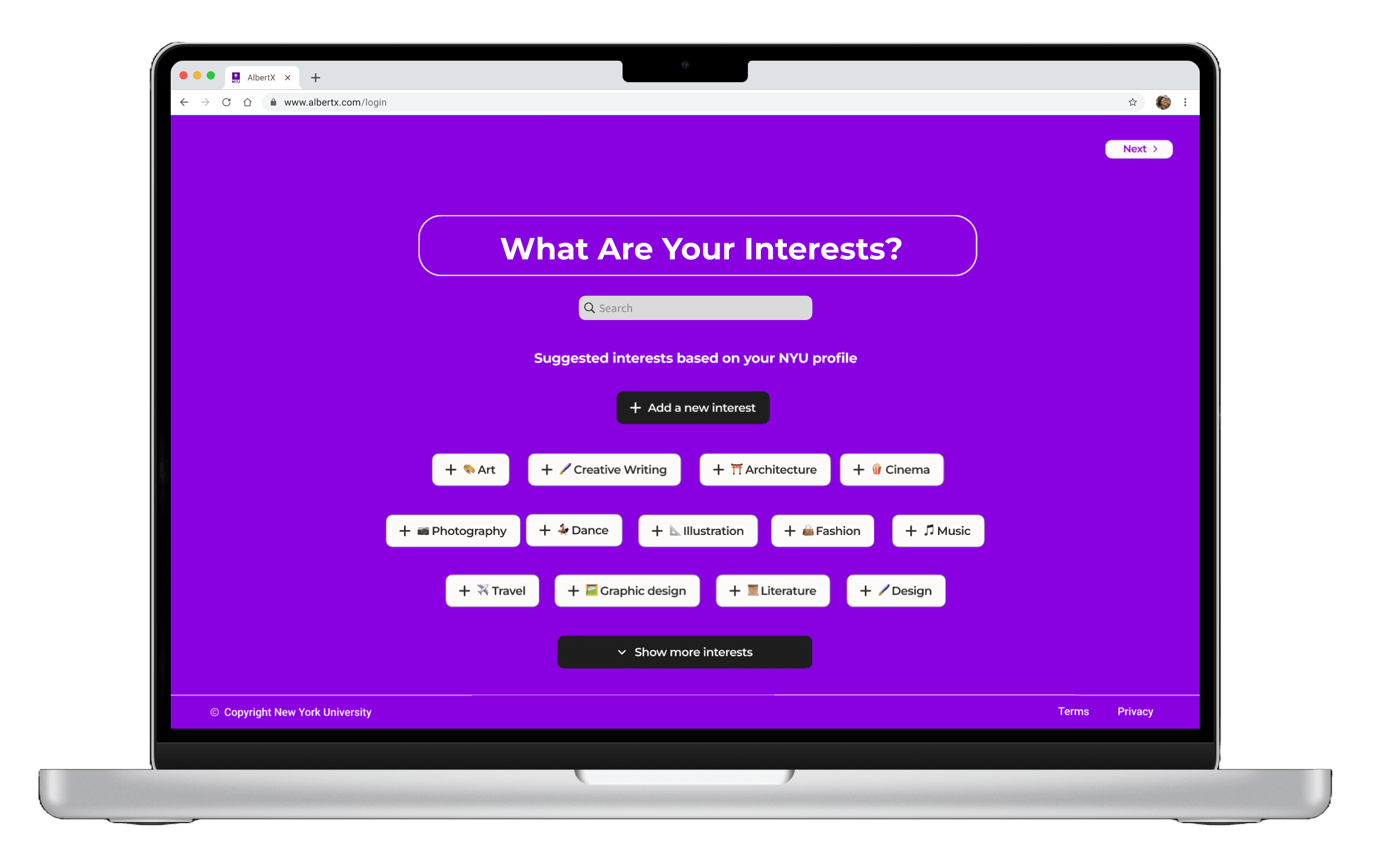

There is a lack of understanding of students' personal journeys.

Why?

Academic advising meetings tend to be limited in time.

Why?

Advisors do not have the availability to solely focus on one student.

Why?

The demand of advisors is higher than the supply.

Why?

NYU's size too large to allocate personal advisors to each student.

Process

We've adopted a user-centric approach, iterative design, and rigorous testing, ensuring that the app met the target audience's needs and preferences effectively.

Research and analysis: The first stage involved researching and analyzing the target audience's financial needs, preferences, and pain points. The team conducted surveys, interviews, and market research to gain insights into user behavior and preferences.

Wireframing and prototyping: Based on the research insights, the team created wireframes and prototypes to visualize the app's features and functionality. The team iterated on the designs based on user feedback, optimizing the user interface and user experience.

User testing and feedback: The team conducted user testing sessions to validate the app's usability, functionality, and design. User feedback was incorporated into the design process to improve the app's effectiveness and user experience.

Development and testing: Once the design was finalized, the app was developed using agile development methodologies. The app was tested rigorously to ensure that it met the highest standards of quality, functionality, and usability.

Launch and feedback: The app was launched in the market, and user feedback was gathered to improve the app's performance further. Feedback was used to refine the app's features and functionality, optimizing the user experience and driving growth.

Interviews

How did/do you plan your coursework?

When do you typically use NYU Albert?

Is there anything that you'd change about the current NYU Albert?

How did/do you plan your coursework?

“First-gen kids who have no idea what they're doing need more guidance [to ensure] graduation on time. I took an extra elective that I didn’t need to.”

Adamary

Student

“It’s hard for an advisor to be intentionally aware of every student and be able to resolve each issue.”

Abigail

Academic Advisor

"To be eligible for class registration, I meet with my advisor for 10 minutes where we recite what classes I am taking based on a basic 4-year path for my major. It’s very surface-level.”

Kora

Student

“Since my English class didn’t work out on registration day, I had to just do a backup, but on the first day I didn’t know how waitlists worked.”

Andrew

Student

Key Insights

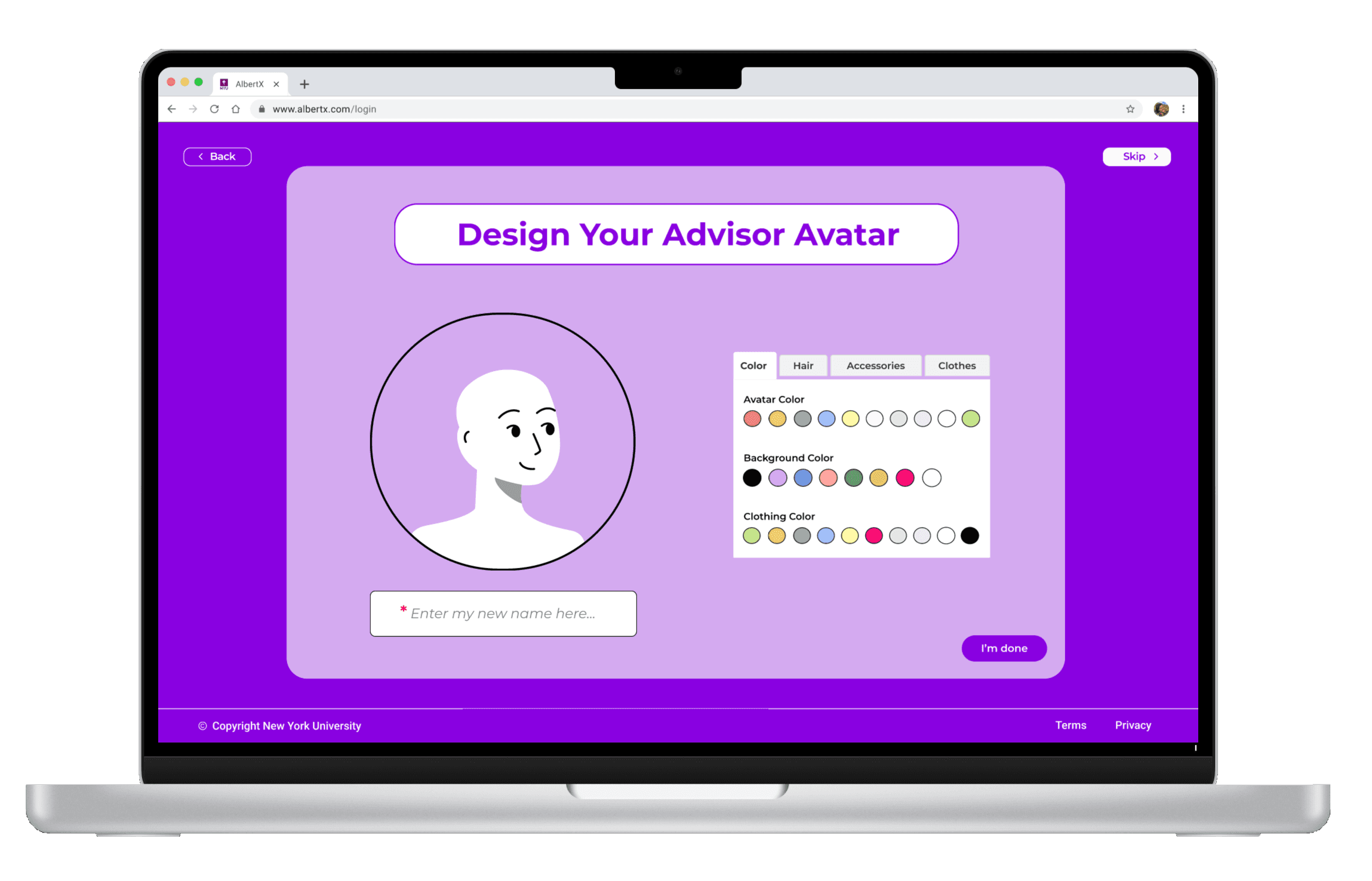

Solution

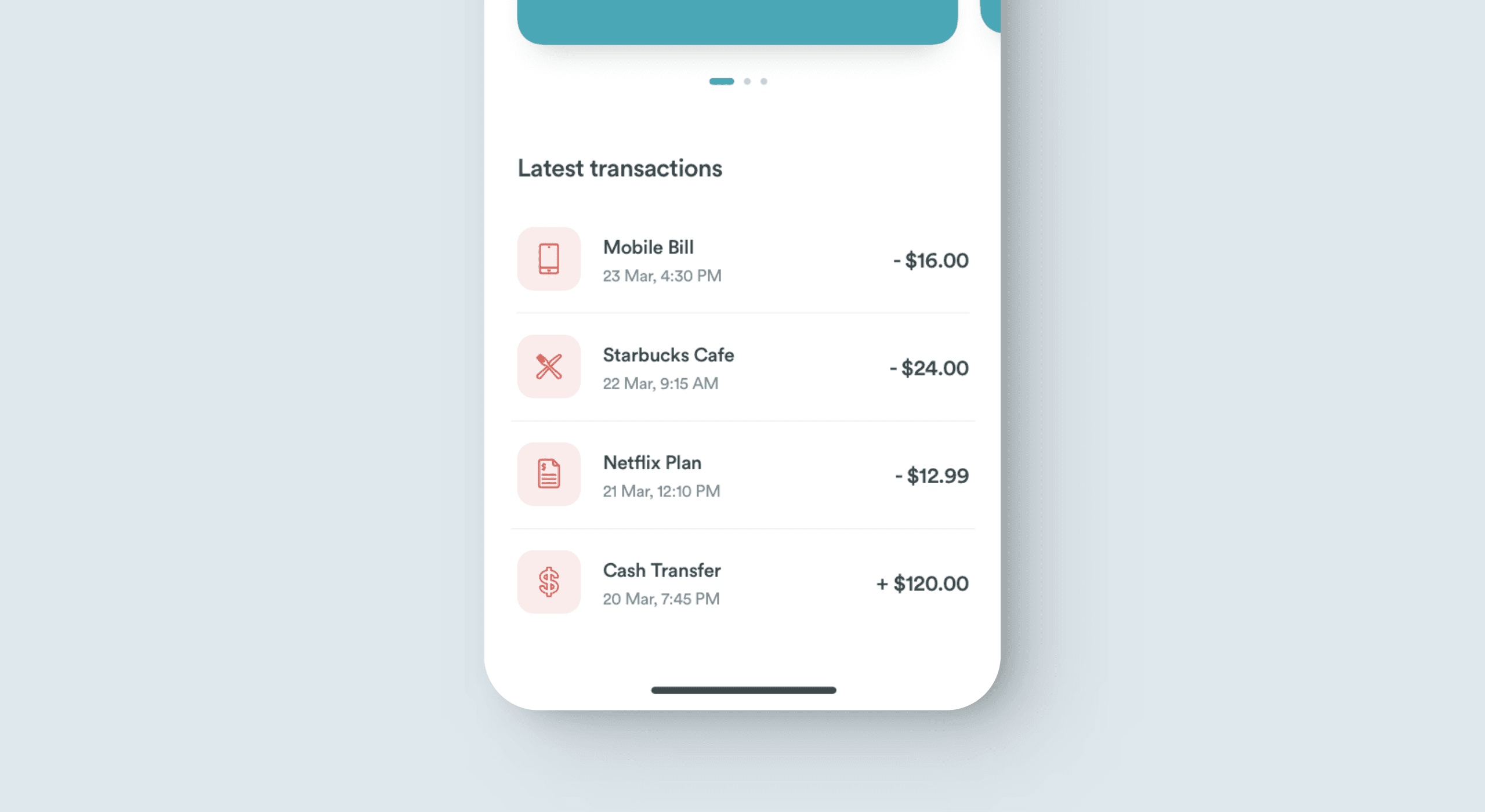

The app's user-friendly interface and intuitive design make it easy for users to track their financial activities in real-time, view their transaction history, and receive alerts for upcoming bills and payments. Users can also set budget goals and receive personalized financial advice based on their spending patterns, helping them stay on track and achieve their financial objectives.

Moreover, the app's advanced security features, including two-factor authentication, biometric login, and data encryption, ensure that users' financial data is secure and protected. The app also integrates with popular financial institutions, allowing users to view their account balances, transaction history, and credit scores in one place.

Stand-Out Features

Improvements After Testing

Basic Design System

Highlighted Screens

Next Steps

The app's success was due in part to its user-centric design process. The team conducted extensive research and user testing to ensure that the app met users' needs and preferences, resulting in a highly effective and user-friendly platform.

The app's range of features, including credit card tracking, transaction management, subscription and bill management, expense control, and budgeting tools, provided users with a comprehensive financial management solution. This helped users to better control their spending, reduce unnecessary expenses, and achieve their financial goals.